Author: EricBBigham , Last Modified, 2022-01-03 Category: Business Keywords: Operating-Model-Strategy-by-Bigham-Consulting

1669 views 45

Return On Equity is arguably the Key Performance Indicator that Banks must control to succeed in any market. Comprised of five key Fundamental Economic Drivers Earnings on assets, Funding Costs Operational Expenses Taxation and Leverage, Operational Expenses are the most controllable driver a CEO has.

The Operating Expense Ratio is determined by two factors, the Asset base as numerator and the Operational Headcount and overhead cost of the organisation. This article will explore the role of Target Operating Model Design on the Operational Expense Ratio and how CEOs can implement a workable strategy that makes a headline change on the ROE of the bank.

Financial institutions have sought to enhance back- and middle office operations to deliver sustainable cost advantages for a number of years. To this end, banks and other financial institutions have often been early adopters of shared services and outsourcing. However, in the face of deteriorating market conditions, increased regulatory scrutiny and larger capital requirements, banks are beginning to explore these traditional model once more.

A shared services model offers banks and their finance functions significant benefits in terms of efficiency and cost reduction. Many banks, however, have had difficulty in implementing shared services programs. They have found their gains limited to savings from labor arbitrage, and have seen even those gains erode as wages rise in different locations. Our experience with shared services indicate that a knowledge of critical success factors, including program ownership by senior management, can help banks realize much more from shared services than was previously thought possible. In addition to major cost reductions, banks can employ shared services to improve service delivery, address changing regulatory concerns, and free up the enterprise to focus on value-creating activities. Banks that take a comprehensive approach to shared services, with a clearly defined strategy, buy-in from stakeholder groups, and a well-designed and wellcommunicated implementation plan, may be in position to gain and maintain an important competitive advantage.

Keywords:Operating-Model-Strategy-by-Bigham-Consulting

Blog title: Operating Model Strategy by Bigham Consulting( 176 articles!)

Gotham City Slots

Gotham City Slots God Bless Technology

God Bless Technology Go Green Stay Green

Go Green Stay Green London Supercar Rally

London Supercar Rally Interest Rates Rise

Interest Rates Rise Karlie Kloss Fitness

Karlie Kloss Fitness  Magnus Walker Porsche 911 Urban Outlaw

Magnus Walker Porsche 911 Urban Outlaw Demure Lady Nude Pencil Sketch

Demure Lady Nude Pencil Sketch What is President Donald Trumps Golf Handicap

What is President Donald Trumps Golf Handicap Funny Dogs - A Funny Dog Videos

Funny Dogs - A Funny Dog Videos How to develop healthy eating and drinking habits.

How to develop healthy eating and drinking habits. Honey Nut Whisky Bakes

Honey Nut Whisky Bakes BREXIT A Clarion Call

BREXIT A Clarion Call Story Telling Presentation Skills

Story Telling Presentation Skills Snake High Score 44

Snake High Score 44 Kate Moss

Kate Moss Marcus Aurelius

Marcus Aurelius James Bond Selfie

James Bond Selfie Movie Legends - Virginia McKenna

Movie Legends - Virginia McKenna Cook Perfect Steak

Cook Perfect Steak Steppenwolf - Born to be wild

Steppenwolf - Born to be wild How To Make An E-Commerce Store Without Shopify

How To Make An E-Commerce Store Without Shopify University Home Page

University Home Page Rock Monsters Iron Maiden Magic

Rock Monsters Iron Maiden Magic Prince Charles receives Montblanc art patronage award

Prince Charles receives Montblanc art patronage award Sketch of a racing horse

Sketch of a racing horse Time For Wine

Time For Wine Banking Key Note Talk

Banking Key Note Talk Affiliate Marketing

Affiliate Marketing Custom Made Plantation Shutters

Custom Made Plantation Shutters Search Engine Inbound Marketing

Search Engine Inbound Marketing Volcano Park

Volcano Park Twenty Two Million Dollar Oceanfront Home

Twenty Two Million Dollar Oceanfront Home Westminster In The Freezing Snow

Westminster In The Freezing Snow How To Sell OMB Digital Coin

How To Sell OMB Digital Coin A Visit To The Wine Country

A Visit To The Wine Country My Rant on TESCO..

My Rant on TESCO..  The 2014: Living in the Shadow of Regulation? Whitepaper Part 1 | Foreword

The 2014: Living in the Shadow of Regulation? Whitepaper Part 1 | Foreword Mobile blogger

Mobile blogger Bitcoin Trading The Ultimate Ponzi Scheme

Bitcoin Trading The Ultimate Ponzi Scheme Tesco Review: Unraveling the Journey

Tesco Review: Unraveling the Journey LEGO 42056 Technic Porsche 911 GT3 RS Building Set

LEGO 42056 Technic Porsche 911 GT3 RS Building Set Eric Bigham FCCA

Eric Bigham FCCA Cat steals some milk during Dean of Canterbury Cathedral's morning sermon

Cat steals some milk during Dean of Canterbury Cathedral's morning sermon Operating Model Strategy

Operating Model Strategy Nakagin Capsule Tower

Nakagin Capsule Tower Digital Marketplaces

Digital Marketplaces Green Blogs

Green Blogs How to build a DIY Garden Gate for Privacy, Security and Style.

How to build a DIY Garden Gate for Privacy, Security and Style. How To Sign Up to OnMyBubble.com

How To Sign Up to OnMyBubble.com CV Preparation

CV Preparation Go Kart Project

Go Kart Project Bargain Holidays

Bargain Holidays Dr Guy Rooney Medical Director Great Western Hospital on the importance of getting your flu jab

Dr Guy Rooney Medical Director Great Western Hospital on the importance of getting your flu jab Sell online with a FREE OMB Online Store

Sell online with a FREE OMB Online Store Sudoku Suite

Sudoku Suite Marketing Scorecard

Marketing Scorecard Fire Fighting Costs

Fire Fighting Costs Breakfast Almond Bakes

Breakfast Almond Bakes  Minus Five UKs Big Freeze

Minus Five UKs Big Freeze How to boil a perfect soft egg

How to boil a perfect soft egg The 2014: Living in the Shadow of Regulation Whitepaper Part 4 | A Strategy For Success

The 2014: Living in the Shadow of Regulation Whitepaper Part 4 | A Strategy For Success God Bless Technology

God Bless Technology The-London-Fitness-Academy-Definition-Of-Nutrition

The-London-Fitness-Academy-Definition-Of-Nutrition Living in the Shadow of Regulation Whitepaper Part 6 - The Global Financial Crisis

Living in the Shadow of Regulation Whitepaper Part 6 - The Global Financial Crisis Top 10 Healthy Foods

Top 10 Healthy Foods The-fashion-queens-Kendall-and-Kylie-Jenner

The-fashion-queens-Kendall-and-Kylie-Jenner Business angels

Business angels Irish Fruit Loaf Cake Recipe

Irish Fruit Loaf Cake Recipe The Wedding Planner

The Wedding Planner Basel 3 Accord The Banking Regulations

Basel 3 Accord The Banking Regulations affiliate marketing tips

affiliate marketing tips Finance Tranformation

Finance Tranformation Marvel Annual

Marvel Annual How to make Chewy Ginger Nut Cookies.

How to make Chewy Ginger Nut Cookies. The 2014: Living in the Shadow of Regulation? Whitepaper Part 2 | Background to the crisis

The 2014: Living in the Shadow of Regulation? Whitepaper Part 2 | Background to the crisis Venture capitalists

Venture capitalists Strategy Consulting Services

Strategy Consulting Services BREXIT A Clarion Call

BREXIT A Clarion Call Stay Cool This Summer With Whiskey Sprite Lime Cocktail

Stay Cool This Summer With Whiskey Sprite Lime Cocktail The 2014: Living in the Shadow of Regulation Whitepaper Part 5 | The Global Financial Crisis

The 2014: Living in the Shadow of Regulation Whitepaper Part 5 | The Global Financial Crisis Garden Owl Painted

Garden Owl Painted  Cost Reduction Strategy

Cost Reduction Strategy I made Jamie's Loaf

I made Jamie's Loaf Unusual Gift Ideas

Unusual Gift Ideas Remy Martin V.S.O.P. Cognac Fine Champagne

Remy Martin V.S.O.P. Cognac Fine Champagne  The 2014: Living in the Shadow of Regulation Whitepaper Part 3 | The Crash

The 2014: Living in the Shadow of Regulation Whitepaper Part 3 | The Crash MAH JONG

MAH JONG New Gamer Launches

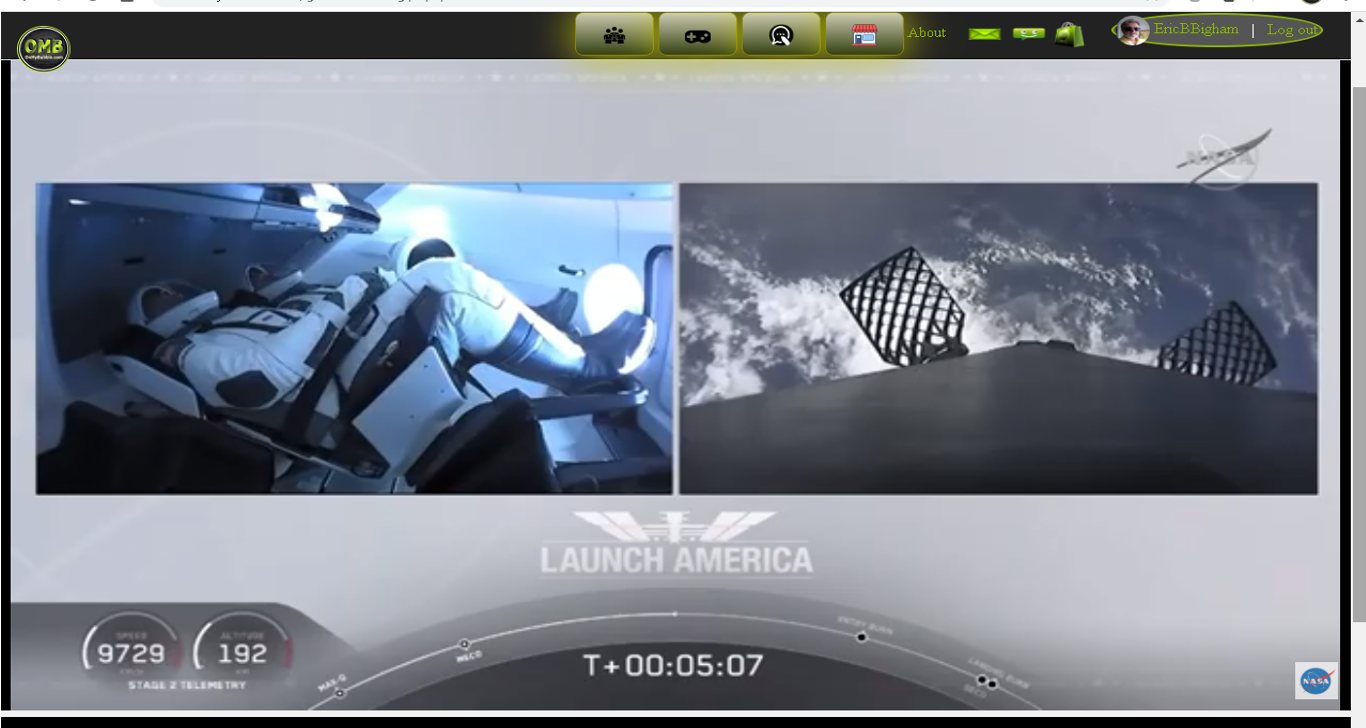

New Gamer Launches Launch America Cancelled

Launch America Cancelled Black Jack

Black Jack Road Rage The Game

Road Rage The Game Monkey Magic Reaching Gandhara

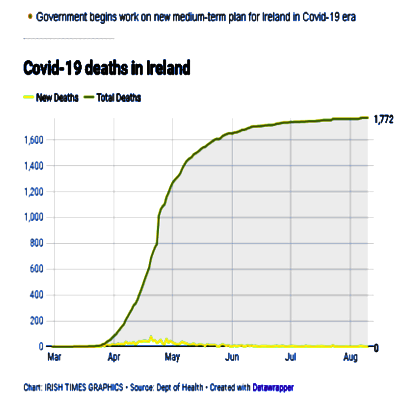

Monkey Magic Reaching Gandhara Irish COVID Chart

Irish COVID Chart Jack Daniels Single Barrel Select

Jack Daniels Single Barrel Select Drambuie Barmbrack Tea Cake

Drambuie Barmbrack Tea Cake Face mask sculpture

Face mask sculpture  Passenger Locator Form

Passenger Locator Form Store Your Cookies

Store Your Cookies  The Worlds Richest Man Talks about Quality Decision Making

The Worlds Richest Man Talks about Quality Decision Making Pool Ball Mania

Pool Ball Mania  Parking Fury The Free Online Parking Game

Parking Fury The Free Online Parking Game Fresh Juice

Fresh Juice Old Holborn Tobacco Tin Pen Stand

Old Holborn Tobacco Tin Pen Stand Coffee Short bread

Coffee Short bread Dublin Bus Old Dublin History

Dublin Bus Old Dublin History Nature's Park Sounds For Meditation & Relaxation

Nature's Park Sounds For Meditation & Relaxation Bump Off Your Bruises

Bump Off Your Bruises Champagne Bar

Champagne Bar Surviving Corona Lockdown

Surviving Corona Lockdown Owl Sketch

Owl Sketch Ginger Bread Loaf

Ginger Bread Loaf House Of The Rising Sun

House Of The Rising Sun Markets rally on news of lockdown measures lift

Markets rally on news of lockdown measures lift  Overview of Internal Migration in Philippines

Overview of Internal Migration in Philippines Apple and fruit tart

Apple and fruit tart  A Target User Test

A Target User Test Summertime unlocked

Summertime unlocked  Beating The Lockdown Blues

Beating The Lockdown Blues Double Chocolate Chip Cookies

Double Chocolate Chip Cookies  I made a Champagne Bar

I made a Champagne Bar  Silver Jug Of Ale

Silver Jug Of Ale Hello Engineer

Hello Engineer Face Masks

Face Masks A Day in the park

A Day in the park How to Make a Wall Sofa Bed

How to Make a Wall Sofa Bed Two Tone

Two Tone Investors in Small Cap and Pre IPO companies cling to the early signs

Investors in Small Cap and Pre IPO companies cling to the early signs Danny Dyer

Danny Dyer Irelands Old Telephone Box

Irelands Old Telephone Box  London Shops Open To Crowds

London Shops Open To Crowds  Why I quit my highly paid dream job

Why I quit my highly paid dream job  War Zone

War Zone How To Make The Perfect Cup Of Earl Grey Tea

How To Make The Perfect Cup Of Earl Grey Tea Cava Cocktails

Cava Cocktails Jules Verne

Jules Verne Wooden Venetian Blinds Cost To Fit

Wooden Venetian Blinds Cost To Fit Guess The Game

Guess The Game  How to use Omeprazole Gastro-resistant hard capsules

How to use Omeprazole Gastro-resistant hard capsules Champagne Cocktails

Champagne Cocktails Dive into Gotham City Slots Unveiling Modern Digital Coin Gaming & Stable Coins!

Dive into Gotham City Slots Unveiling Modern Digital Coin Gaming & Stable Coins! SkyScannerApp

SkyScannerApp Mount-Bromo-Semeru-National-Park

Mount-Bromo-Semeru-National-Park When you do not need to complete the travel locator form and any covid tests

When you do not need to complete the travel locator form and any covid tests OMB Coin

OMB Coin  Why are the Postal Service Self Service Machines failing customers

Why are the Postal Service Self Service Machines failing customers Tradfest Temple Bar

Tradfest Temple Bar the Mercedes AVTR

the Mercedes AVTR Knights In Shining Armani Suits

Knights In Shining Armani Suits First OMBCoin

First OMBCoin  Family part 2 John Paul

Family part 2 John Paul Plantation Shutters

Plantation Shutters Japan to forfeit Olympic Games

Japan to forfeit Olympic Games Being Nemo

Being Nemo How To Present To Senior Management:

How To Present To Senior Management: LaunchAmericaLive

LaunchAmericaLive Freshly baked bread

Freshly baked bread Two Tone Ska

Two Tone Ska Roku Japanese Craft Gin

Roku Japanese Craft Gin OnMyBubble.com

OnMyBubble.com Postponing the Olympic and Paralympic Games

Postponing the Olympic and Paralympic Games Family part 1 Charlo

Family part 1 Charlo Chambord Black Raspberry Liqueur

Chambord Black Raspberry Liqueur Baron De Ley Reserva Rioja

Baron De Ley Reserva Rioja Cookie dough ready to go

Cookie dough ready to go Breakfast Cookies

Breakfast Cookies  Launching Digital Services Automation Systems

Launching Digital Services Automation Systems Another New Blog

Another New Blog Launching Digital Services Automation Systems

Launching Digital Services Automation Systems Family Part 4 Paula

Family Part 4 Paula Custom Montblanc Rollerball

Custom Montblanc Rollerball OnMyBubble.com

OnMyBubble.com Mastering the Art of Manga: A Step-by-Step Guide for Beginners

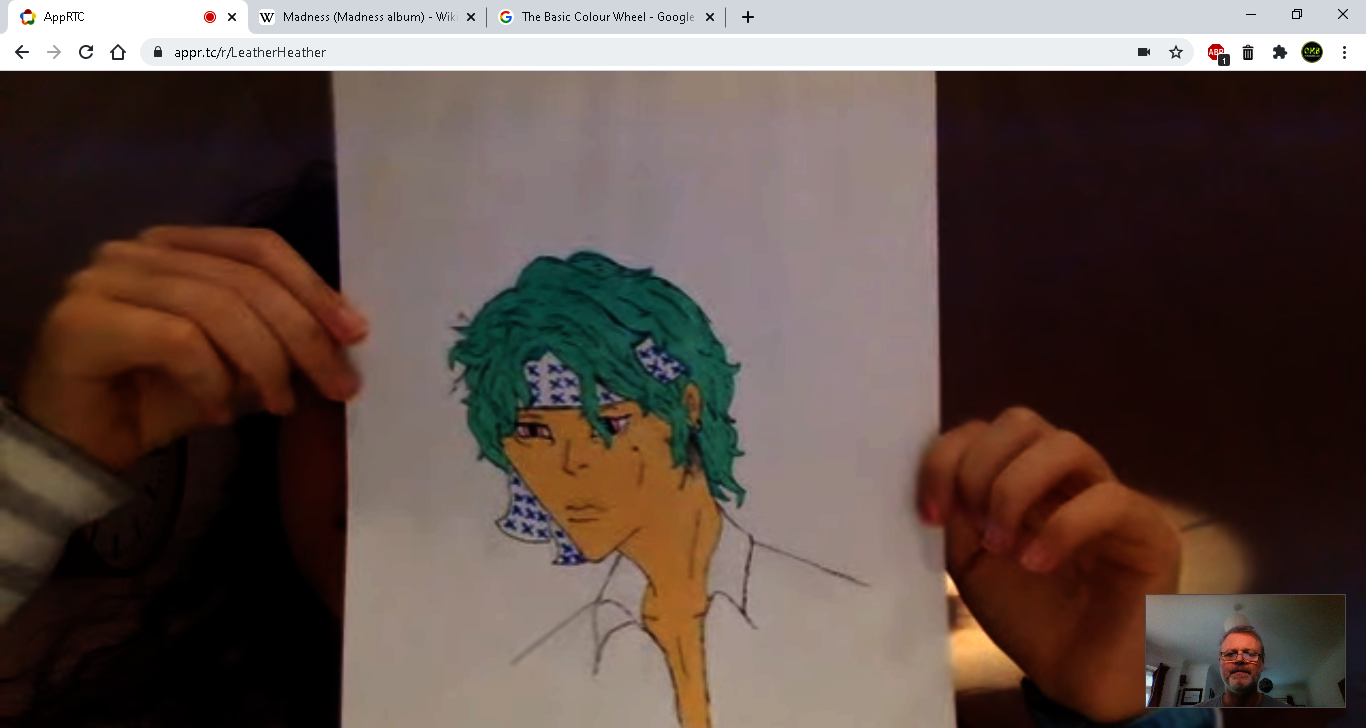

Mastering the Art of Manga: A Step-by-Step Guide for Beginners Gaming Management: Strategies for Success in the Gaming Industry

Gaming Management: Strategies for Success in the Gaming Industry Cave Hunter The Search Infernal

Cave Hunter The Search Infernal BSNStatement

BSNStatement music (59)

music (59) fashion (16)

fashion (16) car (10)

car (10) real_estate (27)

real_estate (27) beauty (8)

beauty (8) travel (21)

travel (21) design (31)

design (31) food (43)

food (43) dating (7)

dating (7) movie (13)

movie (13) photography (5)

photography (5) law (6)

law (6) health (16)

health (16) green (4)

green (4) technology (16)

technology (16) SEO (5)

SEO (5) marketing (11)

marketing (11) history (10)

history (10) lifestyle (18)

lifestyle (18) university (3)

university (3) dog (1)

dog (1) money (10)

money (10) business (59)

business (59) fitness (12)

fitness (12) wedding (7)

wedding (7) education (3)

education (3) science (1)

science (1) shopping (7)

shopping (7) entertainment (11)

entertainment (11) sports (17)

sports (17) cat (6)

cat (6) social_media (1)

social_media (1) medical (3)

medical (3) wine (4)

wine (4) celebrity_gossip (4)

celebrity_gossip (4) DIY (5)

DIY (5) nature (2)

nature (2) gaming (65)

gaming (65) pet (6)

pet (6) finance (35)

finance (35) political (4)

political (4) career (8)

career (8) parenting (4)

parenting (4) economics (16)

economics (16)advertisement

Operating-Model-Strategy-by-Bigham-Consulting OnMyBubble.com